The IMF is facing dilemma regarding sustainability of its funding in Pakistan as it would be hard to defend before the Executive Directors for the Extended Fund Facility (EFF). The unfulfilled commitments by Pakistan for providing financing on the occasion of the approval of the 7th and 8th reviews in August 2022 is another question that the Fund faces before disbursing the next tranche. It is IMF’s credibility in the danger zone if the commitments on external financing needs could not be materialised within the stipulated timeframe.

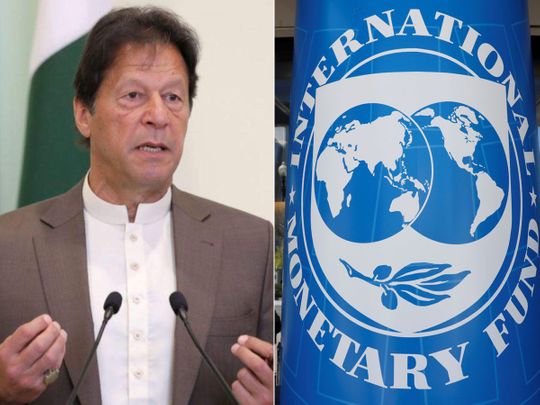

Pakistan has implemented a series of policy measures including increased taxes, higher energy prices and increasing interest rates to the highest in 25 years to unlock funding from stalled IMF USD 6.5 billion lending programme. However, it has become a difficult situation for Pakistani authorities who are facing political uphill task ahead of the forthcoming elections which will decide the fate of commitments of the present government. The IMF thinks that the present government may or may not be there to implement the deal it signs.

The political situation in Pakistan has become a factor in delaying a deal. Prime Minister Shehbaz Sharif said Pakistan has fulfilled the toughest of IMF conditions, which resulted in burdening the masses. He also forewarned that there will be more burden on ‘hardworking Pakistanis’ in the days to come in the wake of these conditions. Still the IMF tranche is not in the sight.

Pakistan was able to navigate the Covid-19 pandemic, the Taliban takeover of Afghanistan, as well as inflation and supply chain disruptions amid Russia- Ukraine conflict. The present crisis is so severe that foreign banks have been refusing to confirm the letters of credit (LCs) for the import of even crude oil. Al- Rajhi Bank of Saudi Arabia is the only foreign bank presently confirming LCs for Pakistani crude oil import.

Finance Minister Ishaq Dar has blamed the delay in the conclusion of discussions with the IMF on the ‘trust deficit’ created by the previous government. Foreign Minister Bilawal Bhutto Zardari also alleged that the IMF is not being fair to Pakistan, adding that the country was in ‘a perfect storm’ of crises. The delaying tactics used by Islamabad for fear of taking tough economic decisions before the elections has done more damage than good.

Bank of America’s Economist Kathleen Oh stated that for Pakistan “unless the payout comes through soon, a state of moratorium looks unavoidable.” “Whether and when Pakistan can receive the next installment from the IMF is still up in the air,” Kathleen further added. Its recent report says that crisis-hit Pakistan will need to pause debt repayments if it isn’t able to secure funding from the IMF quickly enough.

However, the future remains more uncertain. According to the State Bank of Pakistan Governor Jameel Ahmad, country’s central bank, Pakistan needs to repay about USD 3 billion of debt by June, while USD 4 billion is expected to be rolled-over. A loan rollover from Industrial and Commercial Bank of China earlier this month helped to ease pressure on Pakistan. The Pakistani rupee has shaved nearly 20% of its value so far this year. According to Fitch Ratings, default is a real possibility in Pakistan as indicated in its current rating.

China can rescue Pakistan because of its close ties and is the key for relief as the largest creditor. Hence, the hope is rising in Islamabad for China to provide a backstop in bridging the funding gap. However, China has recently expressed serious reservations about overdue payments of USD 1.5 billion to its independent power plants (IPPs), installed under the China-Pakistan Economic Corridor (CPEC). China’s Charge d’ Affaires Pang Chunxue said that overdue payments to the Chinese IPPs is causing huge concern among Chinese businesses. Also Chinese power plants at Hub, Sahiwal and Port Qasim were facing currency exchange restrictions, causing difficulty in coal import.

Global lenders, particularly the IMF, are seeking assurances from Pakistan that the future political setup in the country will respect any deal they sign with Islamabad. The IMF wants Pakistan to show that it can raise enough financial resources to narrow its balance of payments gap. Though China, Saudi Arabia and other partners have come forward with help offers but the IMF thinks it is not enough.

Critics blame that Pakistan has become accustomed to going through a cycle of debt which has become unsustainable. IMF’s success story in Egypt which revolves around policy and structural amendments of three main components like monetary amendments, fiscal amendments, and structural amendments could serve as a model for structural reforms for Pakistan. Similar are the cases of the IMF lending in Serbia and Iceland.

Hope of economic revival is also a mirage for Islamabad. Pakistan’s infrastructure spending is just 2.1% of GDP which is the lowest in the region and well below the required national average of 8-10% of GDP. Infrastructure spending is the most effective and crucial accelerator of long-term and sustainable economic growth and development. It is challenging for Pakistan to finance infrastructure development and its maintenance, which faces huge paucity of capital. The global business scenario is going to be more volatile in view of the current crisis in the US banks along with Credit Suisse. As Islamabad is unable to meet its short term foreign debt obligation and is entangled in the immediate forex crisis, it is very hard to think about its economic revival. Ultimately, it is the poor Pak citizens are the ones to suffer for all these political stalemates and developmental failures as has been the case in the last seven decades.