Pakistan’s rapid adoption of solar energy, driven primarily by market forces and with minimal political support, provides valuable lessons for other emerging markets. Declining solar panel prices, coupled with skyrocketing grid electricity tariffs that have increased by 155% over three years, are fuelling a rush in renewable energy adoption in Pakistan, with solar power leading the way. The country is now the world’s sixth-largest solar market.

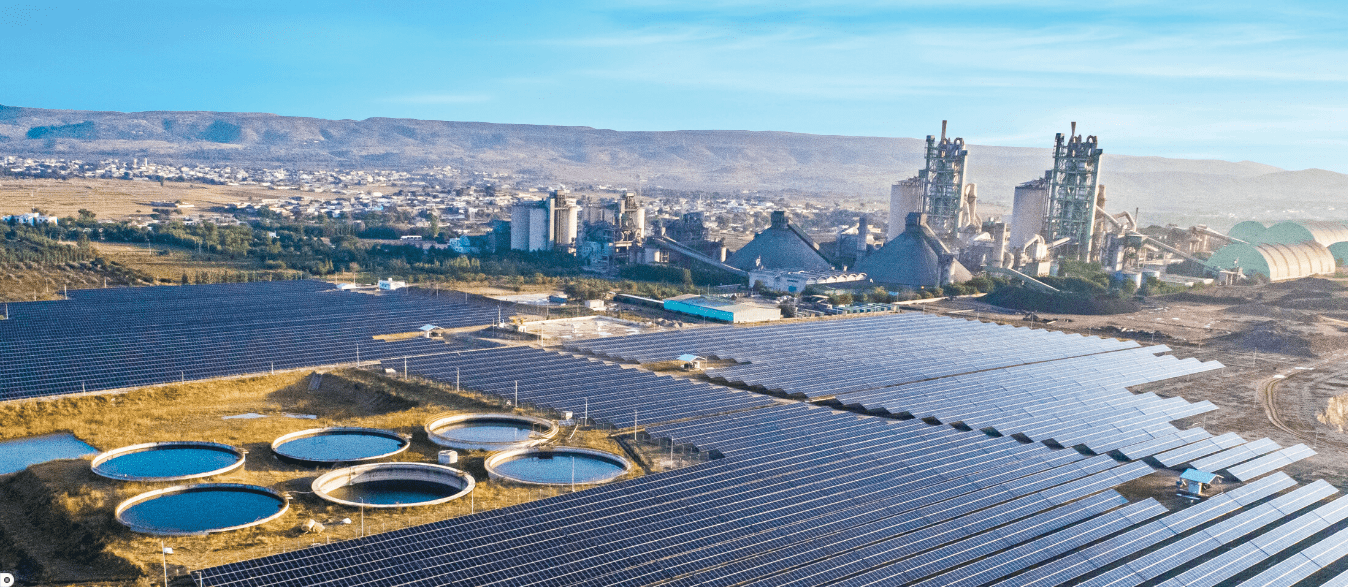

Interestingly, this shift toward solarization has happened largely without active political will, driven instead by external pressures. China’s overproduction of solar panels has lowered costs, making Pakistan the third-largest destination for Chinese exports. Industrial, agricultural and residential sectors have embraced solar, with imported Chinese modules totalling 13 gigawatts (GW) in the first half of the year, and forecasts reaching 22GW by year-end.

As more consumers abandon the grid, the resulting decline in demand drives up fixed costs for those who remain connected, intensifying the burden of capacity payments and further straining state finances. Clean energy, in contrast with the official figures from the country’s electricity regulator, is emerging as the key beneficiary.

These new realities are shaped by the inability of state-owned energy providers and the national grid to deliver a stable supply, a challenge that has consistently hindered economic growth. The International Energy Agency reports that while Pakistan’s per capita electricity consumption grew by 87% between 2000 and 2022, over 40 million people remain without access to electricity, and half the population still lacks clean cooking facilities. Many more live in off-grid or underserved areas, with under four hours of electricity daily. Meanwhile, record-breaking heatwaves are boosting demand for basic cooling like fans. Due to the exorbitant costs and unreliable performance of the power grid, 40-50% of industries rely on captive power plants despite being connected to the grid.

The government’s inconsistent energy policy – characterized by inefficiencies in production, pricing and regulations – has further deepened the energy crises. The recent electricity price hike in July 2024, seen by many as an alternative tax, has driven grid electricity consumption to its lowest level in four years, with a double-digit decline in demand. Grid electricity demand dropped by more than 10% in the past fiscal year as inflated tariffs burden consumers with covering inefficiencies. This trend has sparked a wave of solar adoption among industrial, commercial and private users who can afford self-generation.

Global regulations, such as the European Union’s Carbon Border Adjustment Mechanism, and global brands’ net-zero commitments are adding to the urgency of cleaner energy adoption. Export-driven industries face competitive pressure to source renewable energy or risk losing market share to greener competitors. Without access to renewable energy via the grid or captive units, these businesses are at a significant disadvantage.

The momentum towards solar adoption is further fuelled by growing consumer independence, driven by declining battery prices and the desire for reliable energy availability. Affordable battery-based systems are reshaping demand patterns, accelerating the shift to renewables, particularly solar power. This highlights the urgent need for proactive grid modernization to manage effectively the growing integration of distributed renewable energy sources.

While solarization offers immense opportunities, it also underscores the risks of an unmanaged transition. Pakistan’s case raises questions about the viability of traditional state-run grids and the economic impact of large-scale renewable adoption. A decade ago, the question was: “Can solar power Pakistan?” Today, we explore a critical question: Can Pakistan and other emerging markets realistically transition entirely to renewable energy without jeopardizing the stability of their national grids? With the rapid shift of demand from the grid to rooftop renewables, the national grid is at risk of a downward debt spiral.

Modernizing Pakistan’s national electricity grid is essential for enhancing reliability, expanding access to off-grid areas and significantly reducing costs. This will necessitate the adoption of advanced AI-driven monitoring and forecasting tools, investments in capacity augmentation – including the integration of rapid-response battery storage and digital metering infrastructure – and proactive initiatives by distribution companies to align supply with demand effectively.

Moreover, it will require strong political will to implement comprehensive market reforms, including the privatization and unbundling of distribution companies, to foster a competitive market. However, the prevailing political instability and the high costs associated with grid modernization make these measures unlikely in the current climate. China’s dual role in this transition further complicates the picture. While heavily investing in Pakistan’s thermal power projects, China also benefits as the leading supplier of solar technology, influencing both sides of the energy equation.

Pakistan’s experience offers critical insights into managing the clean energy transition, particularly in integrating renewable energy within complex economic and political landscapes. Global grid operators must reassess their approach to prosumers; consumers who are also producers, and increasingly embracing advanced distributed renewable technologies like solar, wind and battery storage. Transitioning from a government-controlled energy model to a deregulated, competitive market appears essential to avoid grid obsolescence. Such a market can reduce tariffs in the short term, create new revenue streams for grid operators, and reinvigorate demand for grid services.

Creating enabling environments is equally vital. For instance, providing credit facilities for solar adoption in underserved or off-grid communities can accelerate renewable energy integration. At present, well-paying, grid-connected customers often subsidize underserved segments; unbundling these categories could lower tariffs further. Policies that encourage battery usage by consumers, businesses and independent power producers can mitigate challenges such as the duck curve and enhance overall power quality.